XRP Price Prediction: Technical Breakout and Fundamental Catalysts Point to Significant Upside Potential

#XRP

- Technical indicators show bullish momentum with MACD positive divergence and price approaching key resistance levels

- Fundamental catalysts including Ripple's $200M stablecoin bet and Ethena Labs collateral integration provide strong support

- Market sentiment remains positive despite SEC delays, with institutional interest from major financial players accelerating

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum with Key Levels in Focus

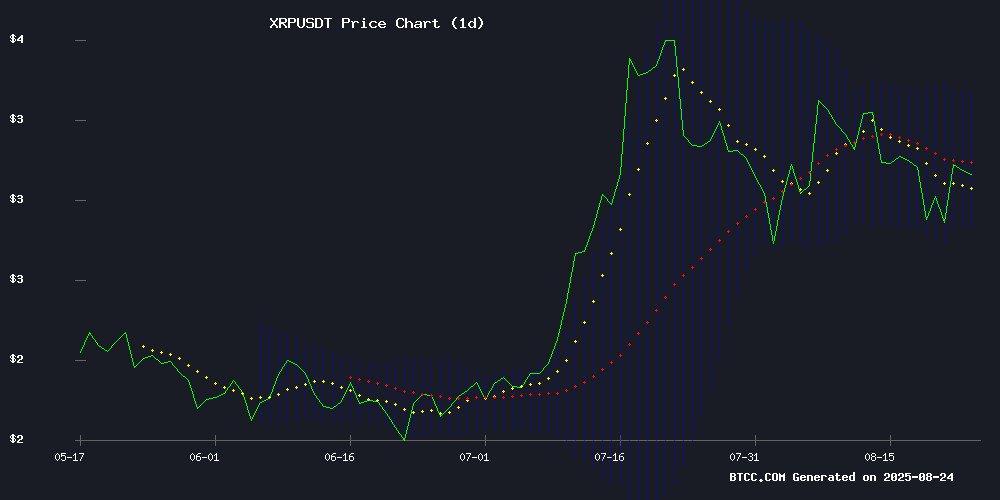

XRP is currently trading at $3.0356, slightly below its 20-day moving average of $3.0939, indicating potential consolidation. The MACD reading of 0.0866 above the signal line at 0.0387 suggests building bullish momentum, with a positive histogram of 0.0479 confirming upward pressure. Bollinger Bands show price action between the upper band at $3.3572 and lower band at $2.8306, with the middle band at $3.0939 acting as immediate resistance. According to BTCC financial analyst Sophia, 'The technical setup suggests XRP is testing key resistance levels. A sustained break above the 20-day MA could trigger movement toward the upper Bollinger Band around $3.36.'

Market Sentiment: Positive Catalysts Drive XRP Optimism

Recent news flow surrounding XRP is overwhelmingly positive, with multiple catalysts suggesting strong fundamental support. The integration of XRP as collateral candidate for Ethena Labs' $11.8 billion USDe stablecoin, Ripple's $200 million stablecoin initiative, and ongoing institutional interest from major players like JPMorgan and BlackRock create a favorable backdrop. BTCC financial analyst Sophia notes, 'The combination of technical momentum and fundamental catalysts creates an environment where XRP could challenge higher resistance levels. While the SEC ETF delay presents short-term uncertainty, the broader narrative remains constructive for medium-term appreciation.'

Factors Influencing XRP's Price

Alleged NDA Links Ripple, JPMorgan, and BlackRock to XRPL Identity Protocol

A leaked Mutual Non-Disclosure and Strategic Cooperation Agreement, shared anonymously by ex-banker Lord Belgrave, suggests Ripple's infrastructure may evolve beyond remittance into identity-linked settlement rails. The document references biometric identity mapping, tokenized instruments, and cross-border settlement via protocol-agnostic mechanisms—likely alluding to XRP's role as a bridge asset.

Swiss banking institutions and US blockchain firms are reportedly involved in developing multilayered liquidity corridors. These WOULD integrate fiat rails, securities tokenization, and CBDCs under compliant, interoperable frameworks—potentially positioning XRPL as a neutral foundation for next-generation financial infrastructure.

XRP Buy Alert: Analyst Predicts $23 Rally as Ripple Gains Momentum

Ripple's XRP is flashing strong bullish signals, with analysts projecting a potential surge to $23. The token has demonstrated resilience through legal challenges while cementing its position in cross-border payments and blockchain efficiency.

Technical analyst Egrag crypto highlights a developing bullish pennant pattern on XRP's macro chart, suggesting significant upside potential. The $23 price target would represent a multi-fold increase from current levels, drawing attention from institutional and retail investors alike.

Ripple's $200 Million Stablecoin Bet: Can It Push XRP's Price to $4?

Ripple's $200 million acquisition of Rail, a stablecoin payment company, positions the firm at the forefront of a burgeoning stablecoin market projected to hit $3.7 trillion by 2030. The MOVE follows the passage of the Genius Act, which legitimizes stablecoins in mainstream finance.

XRP's Core value proposition—streamlining cross-border bank transactions—faces a pivotal moment. While Ripple's technology adoption grows, the direct impact on XRP demand remains uncertain. The stablecoin pivot could either amplify utility or dilute its original use case.

Market watchers debate whether this strategic shift will catalyze XRP's ascent past $4 or introduce new competitive pressures. The answer hinges on how seamlessly Ripple integrates stablecoins without cannibalizing XRP's transactional role.

SEC Delay on XRP ETF Decision Creates Buying Opportunity Amid Market Pullback

XRP has retreated 20% from its 2025 highs despite maintaining a 39% year-to-date gain, as regulatory uncertainty and macroeconomic pressures weigh on the cryptocurrency. The SEC's postponement of decisions on Grayscale and 21Shares' XRP ETF applications until October 18-19 has introduced fresh volatility.

Market participants see potential approval as a watershed moment for institutional adoption. Current SEC leadership's crypto-friendly stance suggests a favorable outcome could catalyze significant price appreciation. The token's technical setup now shows oversold conditions following the recent sell-off.

Inflation concerns persist as major retailers warn of accelerating price pressures. Yet XRP's correlation with traditional risk assets appears to be weakening, with on-chain metrics indicating accumulation by long-term holders during the dip.

XRP Price Prediction and Shift to AI Asset Manager Unilabs Finance

XRP is currently trading at $3.02, with analysts projecting a $3.30 target amid optimism around potential Ripple ETF approvals. The cryptocurrency has found support between $2.85 and $3.00, bolstered by updated filings from asset managers awaiting SEC decisions.

Meanwhile, Unilabs Finance is gaining traction as an alternative investment, attracting attention from Ripple holders with its $30 million in assets under management. The platform's presale performance and real-world DeFi solutions are drawing comparisons to top crypto opportunities of the cycle.

Market dynamics show a divergence: while XRP's predicted upside appears modest at approximately 9%, capital appears to be rotating toward emerging DeFi projects offering higher growth potential. This trend reflects the sector's appetite for innovation beyond established layer-1 assets.

Could Ripple (XRP) Deliver 10x Returns?

Ripple's XRP has surged 397% over the past year, fueled by a crypto-friendly regulatory environment and the resolution of its legal battle with the SEC. The token's potential for tenfold gains hinges on its ability to disrupt the cross-border payments market dominated by SWIFT.

Ripple's blockchain-based solutions offer instant, low-cost international transfers, with XRP serving as a bridge currency through its On-Demand Liquidity (ODL) feature. CEO Brad Garlinghouse projects XRP could capture 14% of SWIFT's $150 trillion annual volume within five years—a $21 trillion opportunity that would drive institutional adoption.

The legacy SWIFT system remains plagued by slow settlement times and high fees, creating ripe conditions for disruption. Ripple's growing network of financial partners suggests the infrastructure for scaling already exists—the question is whether adoption will accelerate fast enough to justify current valuations.

XRP Breaks Key Resistance as Investors Diversify into Cloud Mining

XRP surged past its 2018 all-time high on July 18, peaking at $3.65 before settling into a bullish consolidation pattern. The rally marks a 7% rebound from interim support at $3.20, with technical indicators suggesting potential upside toward $4. Relative Strength Index readings above 50 and firm support at $3 confirm sustained buying pressure.

Seasoned holders are amplifying returns through GMO Miner's cloud mining contracts—converting static holdings into daily XRP yields. The platform eliminates hardware barriers and market exposure, offering renewable-powered computations with cold storage security. Daily settlements provide liquidity for withdrawals or compound strategies.

As Bitcoin and ethereum dominate ETF flows, XRP investors increasingly favor alternative yield mechanisms. GMO Miner's AI-driven infrastructure has become a preferred vehicle, combining regulatory compliance with $15 signup incentives. The trend reflects broader market sophistication—where price appreciation and cash flow generation become parallel objectives.

XRP Price Rally Hinges on Breaking Key Resistance Zone as Whales Accumulate

XRP's upward momentum faces a critical test at the $3.26-$3.29 resistance zone, where over 1.05 billion tokens have historically changed hands. The asset's inability to break through this barrier since early August reflects persistent selling pressure, despite notable accumulation by large holders.

On-chain data reveals a quiet but significant buying spree by whales holding 10-100 million XRP. These addresses increased their holdings from 7.51 billion to 7.76 billion XRP between August 16-24—a $758 million position buildup at current prices. Such accumulation typically precedes major price movements, suggesting institutional confidence in XRP's long-term prospects.

The Cost Basis Distribution Heatmap identifies $3.26-$3.29 as a make-or-break level. Until buyers absorb this supply overhang, XRP's price action may remain rangebound. Market participants are watching whether whale accumulation can finally provide the thrust needed for a decisive breakout.

Ripple (XRP) Price Predictions Spark Debate Amid Market Volatility

XRP enthusiasts are amplifying bold price forecasts as the token stabilizes above $3, a level now seen as a springboard for future gains. The asset recently peaked at $3.65 before retracing, mirroring last year's stagnation at $0.60 prior to its political catalyst-driven surge.

Prominent community figures like Cobb project a climb to $20, while influencer John Squire hints at even more aggressive targets. These predictions emerge despite XRP's history of prolonged consolidation phases punctuated by sharp rallies.

Ethena Labs Approves XRP as Collateral Candidate for $11.8 Billion USDe Stablecoin

XRP has cleared all benchmarks under Ethena Labs' Eligible Asset Framework, positioning it for potential integration as collateral backing the $11.8 billion USDe stablecoin. The cryptocurrency's $181 billion market capitalization and daily trading volumes exceeding $10 billion underscore its liquidity profile.

Only BNB has received formal approval thus far, with XRP and HYPE remaining under consideration. Ethena's framework mandates stringent requirements including $1 billion in average open interest, $100 million daily spot volume, and $500,000 spot order book depth—thresholds XRP has convincingly surpassed.

The asset's enduring market presence and risk management characteristics align with USDe's collateral requirements. Market observers note this development could further institutional adoption pathways for XRP, though final onboarding decisions remain pending.

XRP Predicted to Outperform Palantir Over Next Five Years Despite Recent Lag

While Palantir's stock has surged over 100% year-to-date in 2025 compared to XRP's 40% gain, analysts argue cryptocurrency's upside potential remains undervalued. The prediction hinges on valuation disparities rather than fundamental weaknesses in either asset.

Palantir's staggering 244 forward P/E ratio and 4.12 PEG ratio suggest its AI-driven growth is already priced in. Meanwhile, XRP's blockchain utility in cross-border payments presents asymmetric upside as regulatory clarity improves. Market participants appear to be discounting the digital asset's institutional adoption trajectory.

"Valuation matters most in marathon time horizons," observed one fund manager tracking both assets. The analysis suggests Palantir's enterprise software multiples leave little room for error, while XRP's tokenomics could benefit from broader crypto market expansion.

How High Will XRP Price Go?

Based on current technical indicators and fundamental catalysts, XRP shows potential for significant upward movement. The immediate resistance sits at the 20-day moving average of $3.0939, with a break above this level potentially triggering a move toward the upper Bollinger Band at $3.3572. Medium-term targets could extend toward the $4.00 level, supported by Ripple's stablecoin initiatives and growing institutional adoption. Analyst predictions range from conservative estimates of $4.00 to more optimistic projections of $23.00, though these longer-term targets would require sustained bullish momentum and broader market participation.

| Price Level | Significance | Probability |

|---|---|---|

| $3.36 | Upper Bollinger Band (Short-term) | High |

| $4.00 | Psychological Resistance | Medium |

| $23.00 | Analyst Long-term Target | Low |